Our Drunken Sailors earned and saved much more than we thought, spent even more, causing substantial post-pandemic GDP revisions.

By Wolf Richter for WOLF STREET.

That might explain in part why consumers have held up so well: They’ve made a lot more money and saved a much larger share of it and spent even more than we thought. The Bureau of Economic Analysis today released its annual revisions to inflation-adjusted consumer income, spending and the savings rate. The annual reviews go back five years, but the biggest revisions took place in 2022-2024. And so we get our special tu-tone charts, red for revised dates through August and blue for unrevised dates through July. Get ready.

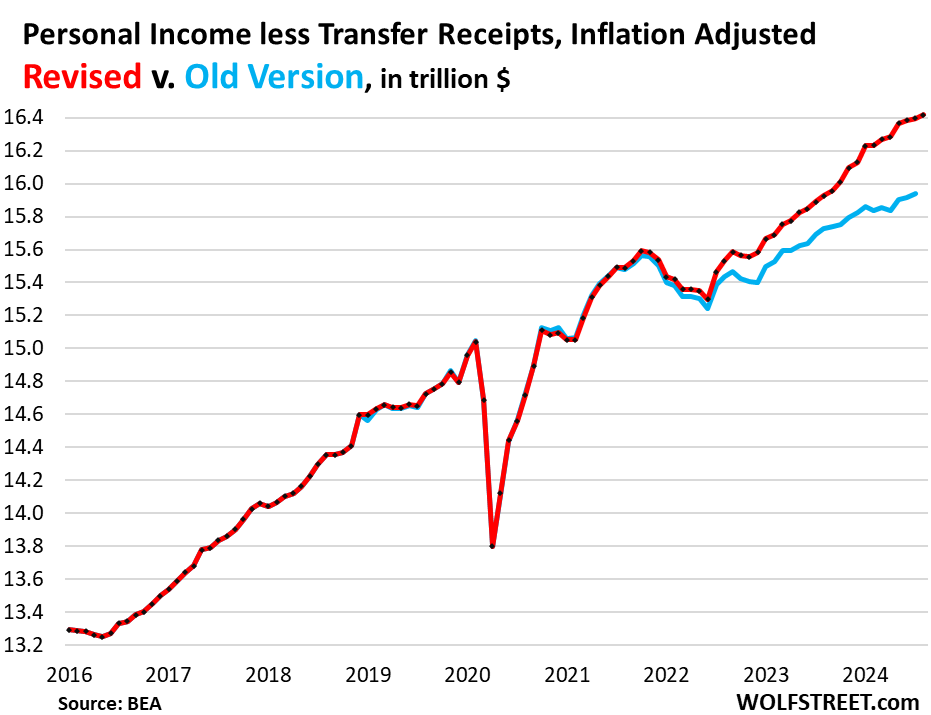

Personal income without transfer receipts, adjusted for inflation:

- August revision: +3.1% year-over-year.

- July revision: +3.2% year-over-year.

- Old version for July: +1.6% year-on-year.

This is income from wages, interest, dividends, rental property, farm income, small business income, etc., but excludes government transfers such as social security benefits, unemployment benefits, welfare, etc.

And this: In the two years between July 2022 and July 2024, personal income without transfer receipts adjusted for inflation:

- Revised version: +6.0%

- Old version: +3.6%!

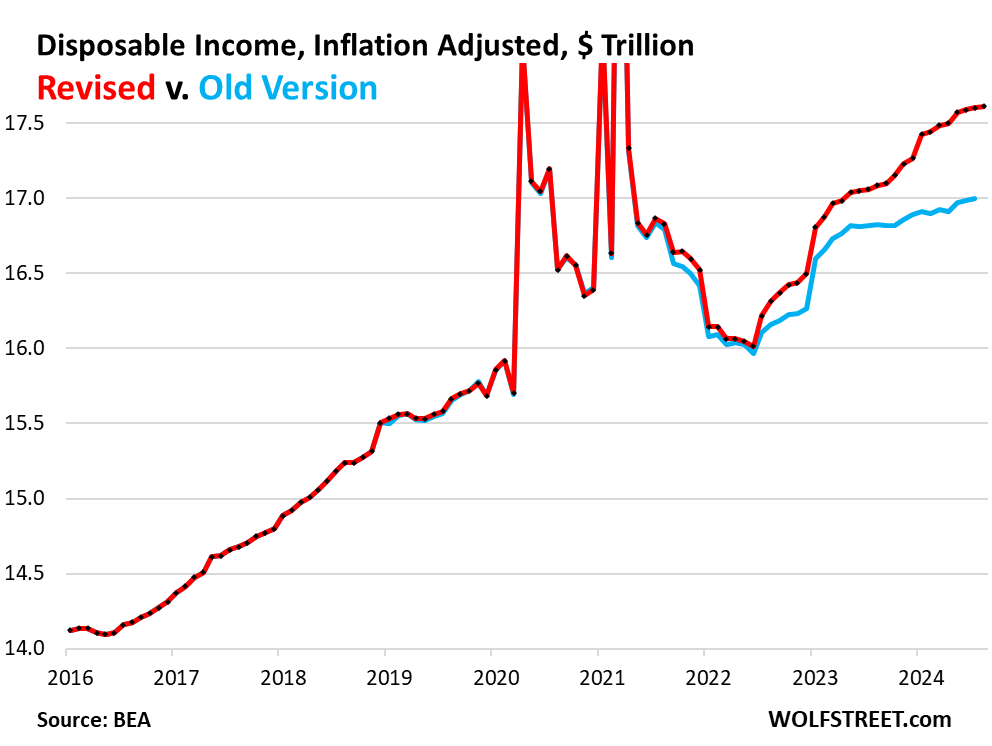

Disposable income, adjusted for inflation:

- August revision: +3.1% year-over-year

- July revision: +3.2% year-over-year

- Old version for July: +1.1% year-on-year.

For the two years from July 2022 to July 2024, adjust for inflation:

- Revised version: +8.5%

- Old version: +5.5%.

Disposable income is income from all sources after income tax and social security payments. Includes income from wages, interest, dividends, rentals, farms, personal business, etc. and from government transfer payments, but excludes capital gains. Disposable income is what consumers have left to spend on goods and services and to save.

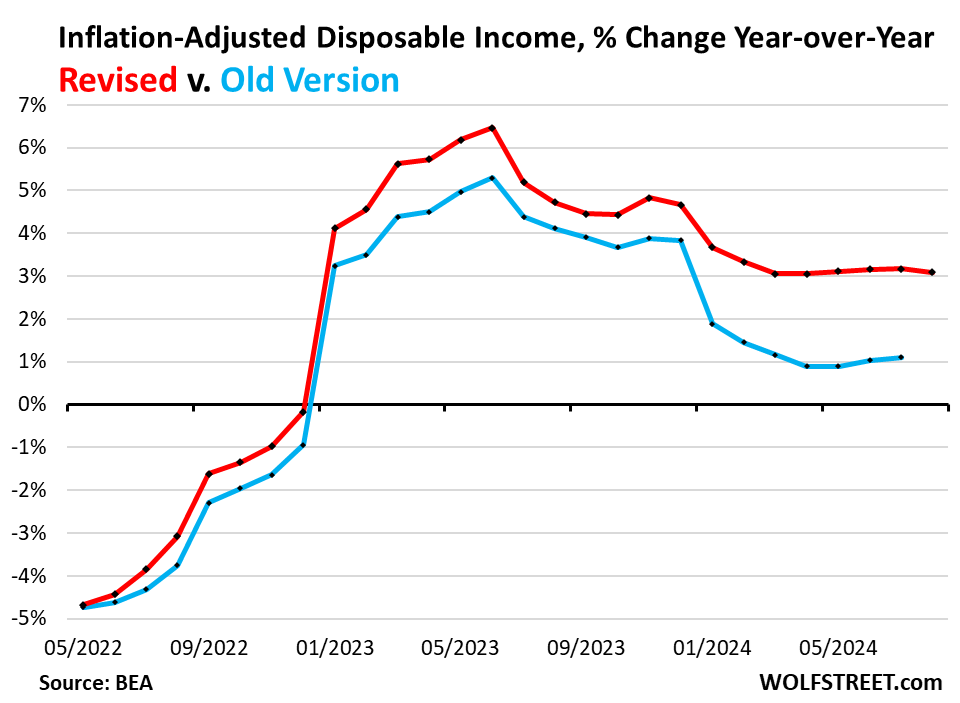

Regarding the year-over-year percentage change in inflation-adjusted disposable income: The last five revised increases (April-August) were over 3.1%, about triple the April-July unrevised increases of about 1 %.

Revised growth in disposable income has outpaced inflation by a wide margin for about two years. Unrevised growth over the same period also outpaced inflation, but not by as large a margin.

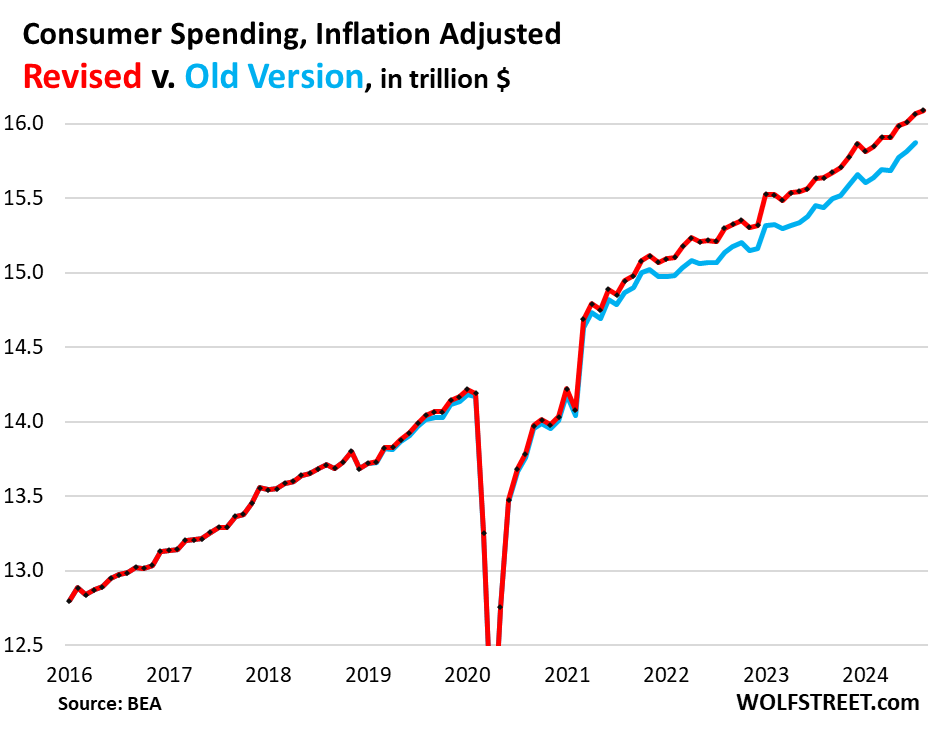

Consumer spending adjusted for inflation:

Oh dear, our drunken sailors, as we’ve come to fondly and facetiously call them around here – was also reviewed above, but by a much smaller amount.

- Revised spending for August: +2.9% year-on-year

- Revised spending for July: +2.8% year-over-year

- Old version for July: +2.7% year-on-year.

In the two years from July 2022 to July 2024, revised inflation-adjusted consumer spending rose 5.6%. The old version in the same period increased by 5.3%.

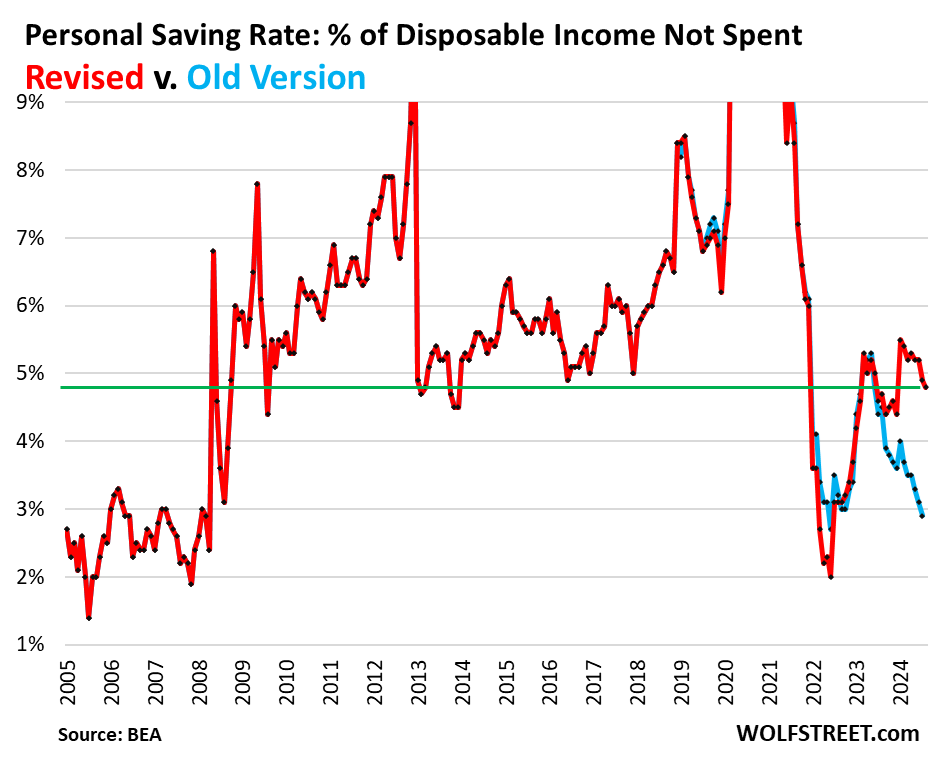

And the savings rate, oh-la-la.

What, our Drunken Sailors were party people? Income was revised massively and spending was revised only slightly, so the savings rate—the percentage of disposable income our Drunken Sailors didn’t spend—was much higher than we thought.

The saving rate in August was 4.8%. The revised savings rate for July was 4.9%. The old version of the savings rate for July was just 2.9%. This is a huge difference:

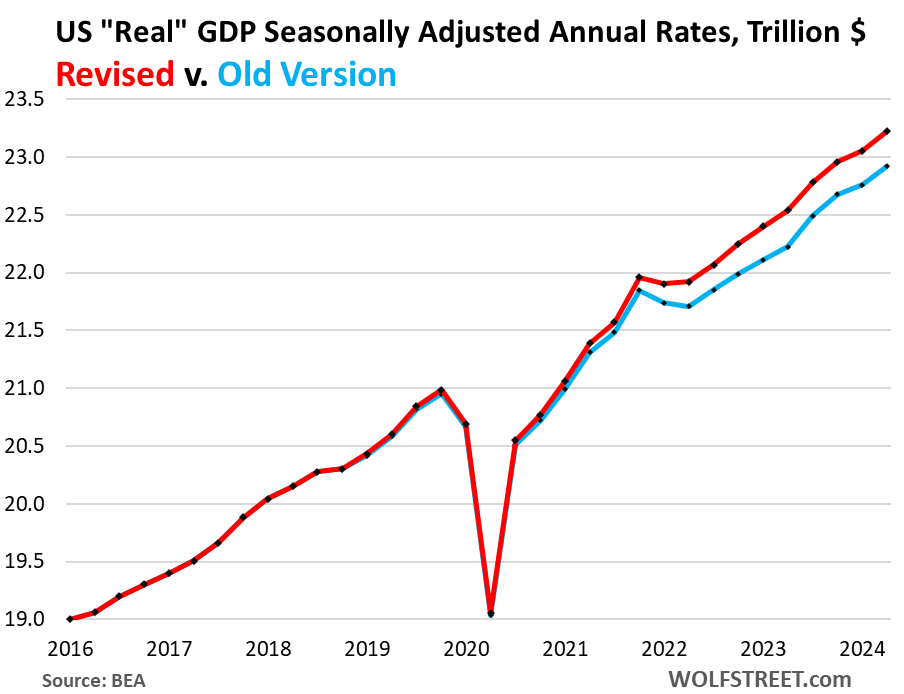

GDP as well.

These revisions also made their way into the GDP numbers going back to the pandemic, and GDP grew much faster in those two years than we thought.

As a result, in Q2 2024, revised inflation-adjusted GDP was $305 billion higher than the old version. From the end of 2021, revised real GDP increased by 5.8%; the unrevised version saw a 4.9% increase over the same period.

Do you enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it enormously. Click on the mug of beer and iced tea to learn how:

Want to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

#Consumer #income #savings #rate #revised #considerably #higher #years #spending #revised #higher #Amazing #numbers