Sometimes a title says it all. And that was certainly the case with Thursday’s Financial Times headline. It shouldn’t have come as a surprise to anyone who has followed the oil market. But it clearly surprised a lot of people.

We first highlighted the possibility in July, suggesting that “Oil prices are heading into a warning triangle again.” And the risk was even more apparent earlier this month when I suggested “OPEC+ risks losing control of oil markets.”

The market surprise and the FT’s decision to own the headline highlight a worrying lack of investor attention to critical developments in the world’s most important commodity market.

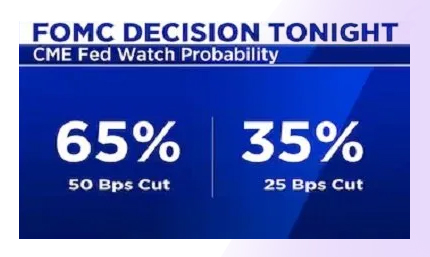

THE MARKET PREFERED TO BET ON INTEREST MOVEMENTS

Over the past month, investors have focused instead on whether the US Federal Reserve would cut rates by 0.25% or 0.5% at its September meeting. On the day of the decision, the bet was 2:1 on 0.5%, as reported by CNBC.

Obviously, this was a great game for traders who know how to play volatility to their advantage. But otherwise, the decision was really just a “feel good” factor for voters ahead of the election:

- Interest rate changes usually take 12 – 18 months to have a full impact on the economy

- So we are only now seeing the full impact of the March 2022 – July 2023 Fed rate hikes that took interest rates from 0.25% to 5.25%

- Against this backdrop, this month’s cut is unlikely to have much of an impact outside of Wall Street

TEA PRICE MOVEMENTS HAVE MUCH MORE IMPACT ON ORDINARY CITIZENS

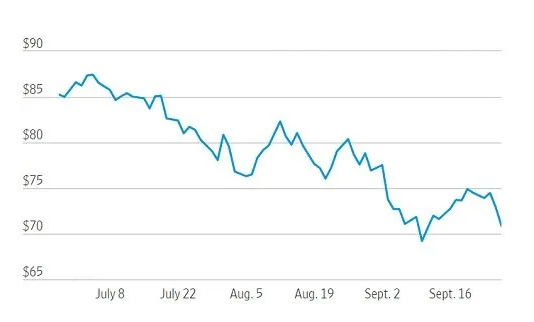

Brent Crude Futures

Advanced charts

The price of oil is much more important to Main Street. And as the Wall Street Journal chart confirms, it has been declining for the past 3 months.

Also important, as the US Energy Information Agency (EIA) reports, gasoline prices fell during the peak summer season. At the end of March, they averaged $3.67/gal, but fell 13% last week to average $3.19/gal.

And now, of course, we can expect prices to fall further, and probably faster, as OPEC+ aims to regain lost market share.

This is a remarkable development considering that Israel is about to start another war in Lebanon. The last time this happened, in July 2006, Brent prices rose from $67/bbl to $78/bbl between June and August, before falling back to $51/bbl when it ended.

But this time, prices have fallen, although the risk is still rising.

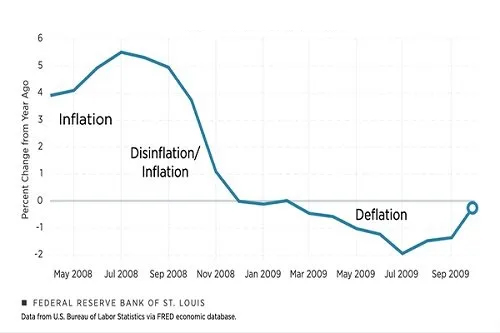

A drop in oil prices could be the catalyst for deflation

Consumer price index

What happens next is obviously the key question. There is clearly a risk that Iran will intervene in the war and possibly close the Strait of Hormuz. As the EIA notes:

“The Strait of Hormuz is the most important oil choke point in the world because large amounts of oil flow through the strait. In 2022, its oil flow averaged 21 mbdor the equivalent of approximately 21% of global petroleum liquids consumption.”

If that were to happen, then oil prices would likely rise – almost certainly to $100/bbl and probably much higher.

But if Iran remains on the sidelines, then prices are likely to come under pressure given the OPEC+ decision. It may drop back to $30/bbl like in the past before this process ends.

In turn, this could be the catalyst for a 2009-like move to deflation, as the St Louis Fed chart illustrates.

This time could lead to a much longer period of deflation and major changes in consumer behavior:

- Most of us have only known inflation, so we naturally assume that it makes sense to buy today if possible because prices will be higher tomorrow.

- But deflation would reverse this pattern. With deflation, it would make sense to wait and buy tomorrow as prices will then be lower.

That is why developments in the oil market require special attention. If prices now fall below $50/bbl, then central banks will likely rush to make major interest rate cuts. And that will make deflation even more likely.

#Deflation #risks #rise #OPEC #aims #regain #market #share #oil #prices #Chemicals #Economics