Friday, September 27, 2024 ▪

5

min read ▪ by

For centuries, banks have dominated our economy, asserting themselves as the undisputed masters of the financial system. But behind this respectable facade, there are less than flattering practices. The study of 60 million consumers reveals that major banks such as BNP Paribas, Société Générale and Crédit Agricole are accumulating social, environmental and fiscal abuses. This damning observation highlights questionable management that is having a profound impact on their customers and economic future.

Economy and Environment: The Hidden Cost of Big Banks

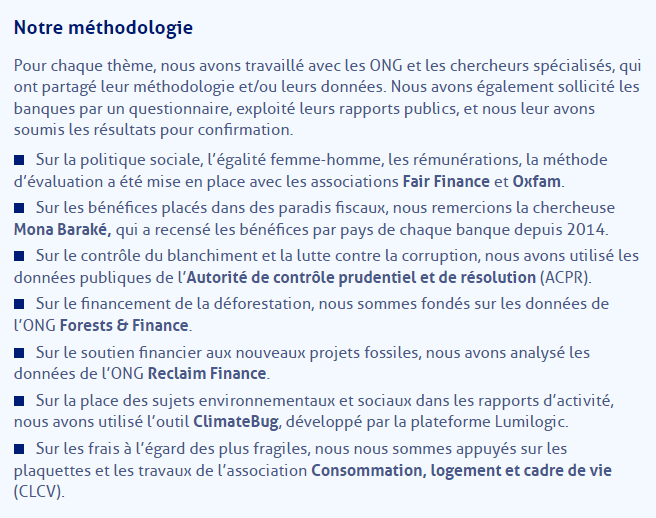

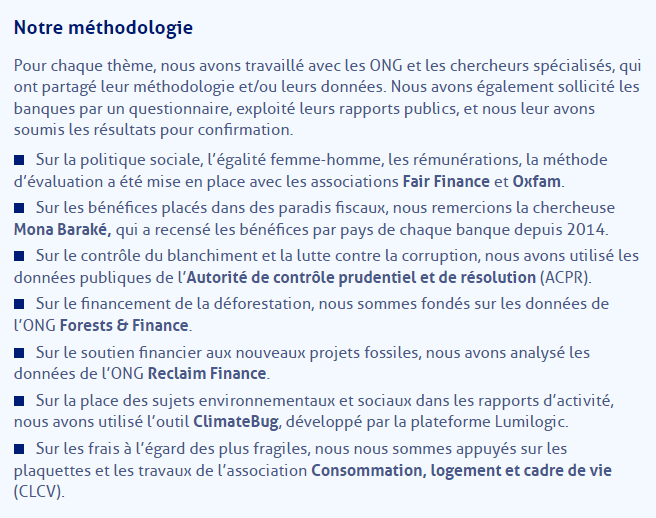

The major banks, supposed to be the backbone of the global economy and logically in the green after the appointment of Michel Barnier as Prime Minister, are proving to be major players in questionable environmental practices. The study carried out by several NGOs, associated with 60 million consumers, shows that institutions such as Crédit Agricole, Société Générale and BNP Paribas they are not as virtuous as they pretend to be.

Their massive support for fossil projects or industries responsible for deforestation it is damning evidence. Agricultural Creditoften referred to as the “green bank”, invested 243 million euros in companies involved in Brazilian deforestationwhile BNP Paribas has lent almost 2 billion euros to these industries.

These banks, while showing environmental commitments, do not hesitate to do so maximize their profitsoften to the detriment of the planet’s ecological future.

As regards fiscal transparencyit’s a real optimization festival. Societe Generalefor example, he invested 16% of its profits in tax havens. But that’s not all: these major banks are also followers evasion of anti-money laundering and anti-terrorist financing measures.

Here are some key figures from the report:

- Crédit Agricole: 243 million euros in deforestation;

- BNP Paribas: 2 billion euros lent to destructive companies;

- Société Générale: 16% of profits in tax havens.

All this leaves a bitter taste as to the real commitment of these institutions to a more sustainable future.

TradFi: social and tariff practices under control

The world of traditional finance (TradFi) is also under attack from this report, revealing that major banks, notably BNP Paribas and Société Générale – the latter behind a recent Euro stablecoin project on Solana, are implementing extremely harsh social and tariff policies towards their most vulnerable customers. Dealing with overdrafts and exorbitant bank fees have become a real nightmare for those facing financial difficulties.

These units do not hesitate charges exorbitant prices for debit account notification lettersfurther burdening already suffering customers.

Société Générale stands out with a staggering pay gap: its CEO, Slawomir Krupa, receives 45 times the average salary of its employees.

The inequalities do not stop there. The study highlights a glaring inequality in gender parity in senior management positions. The governance of these institutions remains predominantly male, and efforts to promote real gender equality remain timid at best.

From a general perspective, TradFi appears to be completely outside of current social expectationsfar from the ideals of justice and solidarity that they should embody.

This observation raises a fundamental question: how can banks, they should serve the economy and their customersjustify such practices? It is becoming apparent that promises of social and environmental responsibility are often just a facade to mask deep-rooted abuses.

Fortunately, banks like Goldman Sachs and BNP Paribas are starting to integrate bitcoin (BTC) and other cryptocurrencies into their ecosystems, proving that some financial institutions are finally becoming aware of the challenges of the future. Or is it a smokescreen?

Maximize your Cointribune experience with our Read to Win program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The blockchain and crypto revolution is underway! And the day the impacts are felt on the most vulnerable economy in this world, against all hope, I will say I had something to do with it

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be taken as investment advice. Do your own research before making any investment decisions.

#Economy #Doubtful #practices #French #banks #exposed